straight life policy formula

Rate of depreciation. The term straight refers to the whole life insurance policys premium structure.

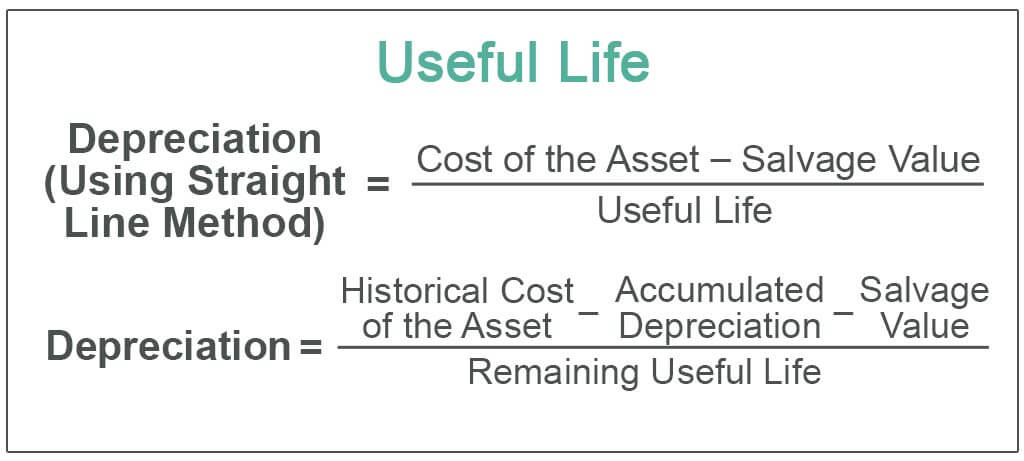

Useful Life Definition Examples What Is Asset S Useful Life

Reviews Trusted by 45000000.

. Unlike the other benefit options straight life has no provisions for extending annuity payments to a beneficiary or survivor for an exception. Determine the cost of the asset. Estimated assets value at the end of useful life.

No Visits to the Doctor. Straight life insurance is a type of permanent life insurance. Straight life policies are designed to provide a steady stream of income to annuitants.

Rates starting at 11 a month. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. Ad No Medical Exam-Simple Application.

See your rate and apply now. International Risk Management Institute Inc. Ad Compare the Best Life Insurance Providers.

The straight life option pays a monthly annuity directly to the retiree for life. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period.

The straight line calculation steps are. Other permanent life insurance plans such as adjustable life insurance can have a premium structure that changes over time. A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single.

Rate of depreciation of an asset having a useful life of 8 years is 125 pa. 2022 Reviews Trusted by 45000000. Determine the useful life of the asset.

As Low As 349 Mo. On the death of the retiree the monthly payments end. Depreciable Base 20500 1500 19000.

Get a Free Quote Online. Purchase price and other costs that are necessary to bring assets to be ready to use. The assets straight line depreciation is.

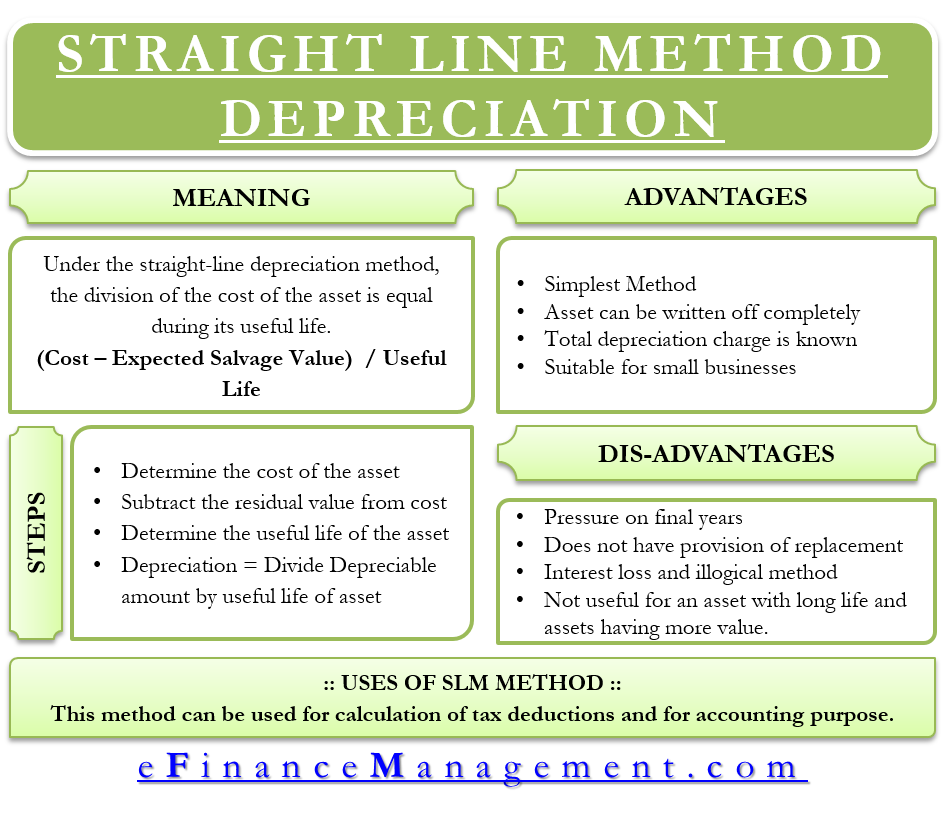

The difference is then divided by the assets expected life to find the annual depreciation expense amount. Straight Line Depreciation 1900020 950. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion.

Because the payouts will be shorter in duration they offer the highest periodic. 1 8 x 100 125 per year. Motion in a Straight Line is a one-dimensional motion along a straight line.

Ad Exclusive term life insurance from New York Life. Ad Save Precious Time Money While Getting the Best Possible Coverage. Such type of insurance helps your family prepare for the sudden.

This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the duration of the policy. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. Up to 150000 in coverage.

When compared to other investments straight life policies may offer annuitants numerous benefits such as. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. The goal of a permanent policy is to have life insurance in place for the rest of your life.

The result is a. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. The number of years that company expects to use an asset.

2022s Top Life Insurance Providers. Straight life insurance is more commonly. The guaranteed death benefit can help replace a familys.

The straight line depreciation formula for an asset is. Because straight life policies dont include a death benefit component they typically come at a lower cost. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefitLike all annuities a straight life annuity provides a guaranteed income stream until the death of the annuity owner. Rate of depreciation can be calculated as follows.

A straight life annuity is tax-advantaged just as other annuities. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income. Straight life annuities do not include a death benefit so payments cant be made to a beneficiary.

Visit to learn more about uniform and non-uniform motion in a. It is also known as ordinary life insurance or whole life insurance. Thus Company X only needs to expense 950 instead of writing off the assets full cost in.

Straight life is the simplest benefit option offered by APERS. In addition company needs to spend 10000. Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount.

Non Life Insurance Policy Types Features And Benefits Whole Life Vs Universal. Company ABC purchases new machinery cost 100000 on 01 Jan 202X.

Depreciation Methods Principlesofaccounting Com

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

Straight Line Depreciation Formula Guide To Calculate Depreciation

What Is Straight Life Insurance Valuepenguin

Depreciation Formula Calculate Depreciation Expense

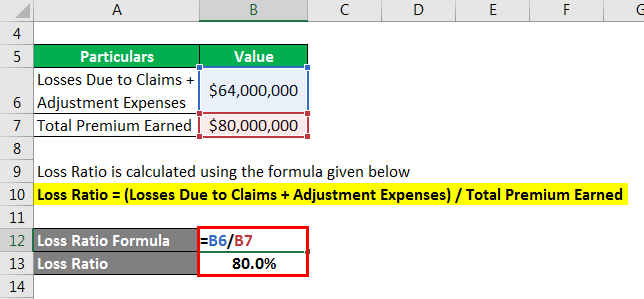

Loss Ratio Formula Calculator Example With Excel Template

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Template Download Free Excel Template

Salvage Value Formula Calculator Excel Template

Straight Line Depreciation Efinancemanagement

Straight Line Equations Definition Properties Examples

Joint And Survivor Annuity The Benefits And Disadvantages

Loss Ratio Formula Calculator Example With Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Straight Line Equations Definition Properties Examples

Period Certain Annuity What It Is Benefits And Drawbacks

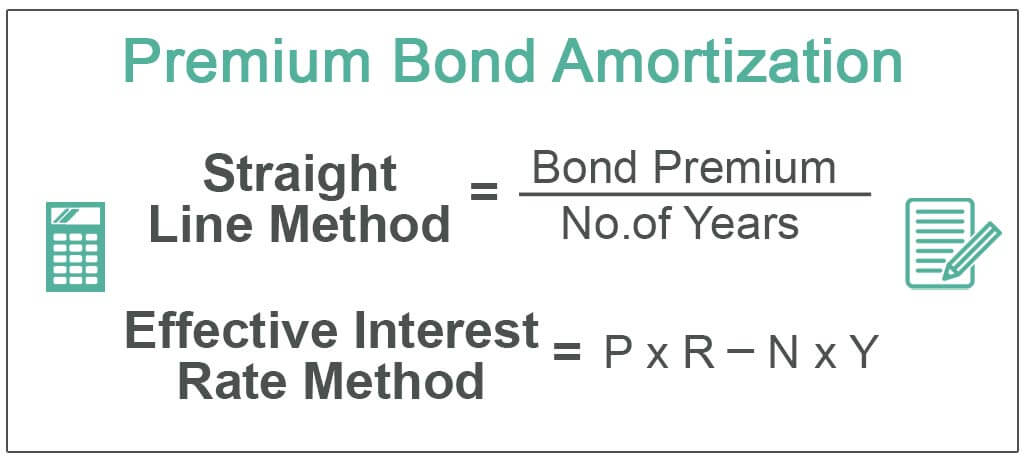

Amortization Of Bond Premium Step By Step Calculation With Examples

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)